JOHNSON EXPERT CREDIT & TAX SERVICES

We are a financial services company dedicated to helping you achieve Better Credit, Better Finances, and a Better Lifestyle.

Visit Us for More Expert Credit Tips & Strategies

All Your Information is Protected When You Sign Up

The Time Is Now!

Secure Your Future: Take the Steps for Comprehensive Insurance Coverage !!

Take action today to safeguard your loved ones and secure your assets. Each step you take, including getting an insurance quote, brings you closer to achieving your vision and reaping the rewards of a brighter future.

Better Credit, Better Finances, and Better Approval Rates!!!

Here Are Your Best Next Steps...

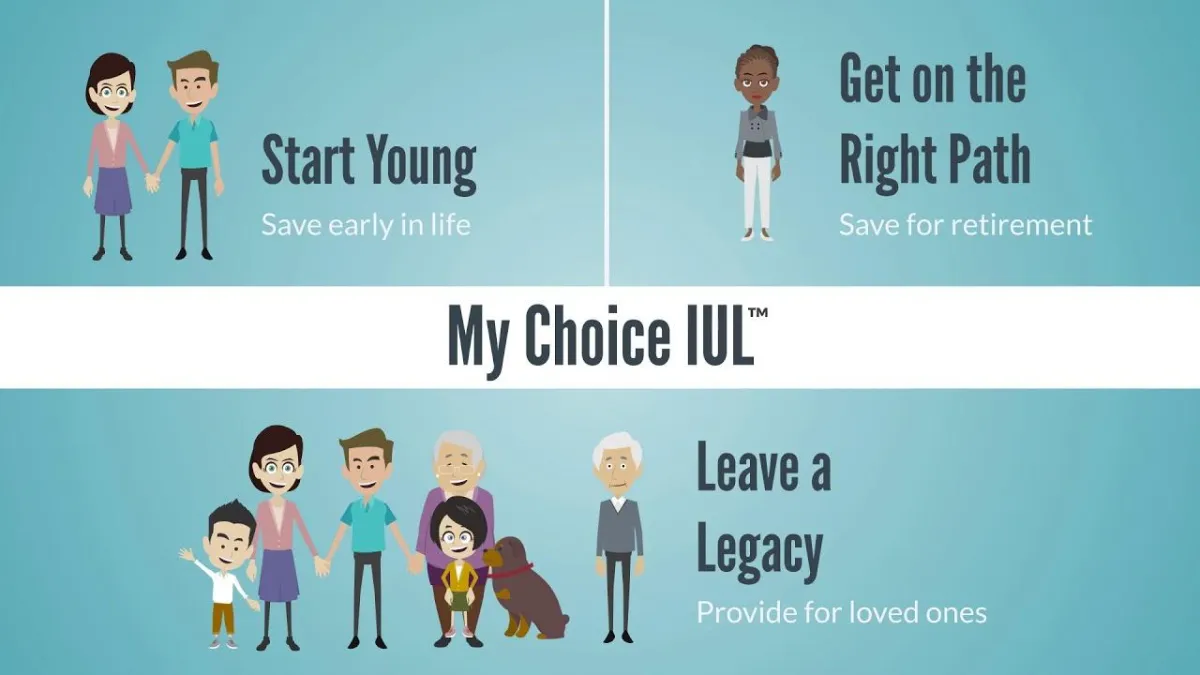

Unlocking Financial Growth: A Business Owner's Success with an IUL Policy...

In 1995, when Mark was introduced to Index Universal Life (IUL) insurance, he was initially skeptical. He had never heard of this type of policy until his friend, James, a business owner, shared his experience. James explained how he used the accumulated interest from his IUL policy to start his business. Back then, the interest rate on IULs had soared to an impressive 12%, thanks to favorable market conditions and the performance of the S&P 500.

James had been contributing $10,000 annually to his IUL policy. With the high interest rate of the mid-90s, his policy's cash value grew significantly, providing a substantial financial cushion. This growth allowed him to tap into his policy’s cash value to fund his business ventures without the hassle of traditional bank loans.

Fast forward to the early 2000s, specifically 2003, another favorable year for IULs, where the interest rate reached around 9%. This growth was attributed to a booming stock market and a favorable economic climate. By this time, James's IUL policy had not only supported his business but also provided a steady increase in cash value, which he could access for various financial needs.

Intrigued by James's success, Mark decided to contact Johnson Family Insurance Group. He was impressed by how James understood wealth and how society doesn't teach us much of this and he explained how we put money in bank accounts like - Checking Account: No interest, or growth and he went on to compare the IUL to other financial products:. - Whole Life Insurance: Steady growth, but less flexibility. - Annuities: Guaranteed income, but less growth potential compared to IULs.

Understanding the unique benefits of an IUL, Mark added this policy to his existing coverage. He also decided to include an annuity to secure a guaranteed income stream for his retirement. Mark valued the IUL for its potential high returns linked to market performance, the tax advantages, and the ability to access the cash value for emergencies or opportunities.

Mark's primary goal was not to start a business like James, but to ensure his family was financially protected. He wanted to safeguard his children's future, cover educational expenses, and be prepared for any unexpected financial needs.

The Benefits and Considerations of IULs:

- Flexibility: IUL policies offer the flexibility to adjust premiums and death benefits.

- Growth Potential: Cash value growth is linked to a stock market index, offering higher potential returns compared to traditional whole life policies.

- Tax Advantages: The cash value grows tax-deferred, and policy loans are typically tax-free.

- Market Risk: While IULs offer growth potential, they are also subject to market fluctuations, which can affect the policy’s performance.

- Complexity: IULs can be more complex than other life insurance policies, requiring careful management and understanding.

By comparing the different financial products and understanding their unique benefits, Mark was able to make an informed decision that aligned with his financial goals and the protection of his family...

If you're curious about how IULs can benefit you or want to explore the best options for protecting your family's future, contact Johnson Family Insurance Group today. Let's have a conversation about your financial security and how to make the most of your insurance coverage.

Click link below to Access, Monitor, & Protect Your Credit Scores

#Become an Authorized User

The Williams Family Established their kids credit at an early age...

Ask a relative or friend with a long record of responsible credit card use and a high credit limit to add you to his or her card as an Authorized User. The account holder doesn’t have to let you use the card — or even tell you the account number — for you to benefit.

This works best for people who have either No Credit, Bad Credit, or very Little Credit, and the impact can be significant. It can fatten up your credit profile, give you a longer credit history, lower your credit utilization, and basically give you an "INSTANT" boost in your credit scores.

Don't know any personal friends or family who can add you as an authorized user to their good credit tradeline???

NO Worries..... we've got you covered!!

If you need access to an Authorized User Tradeline for an "Instant" boost in your credit score, click here to learn more.

Putting It All Together

The combination of these strategies is a surefire way to a successful rod to Financial Freedom.

Visit Us for Your Insurance Needs & More

All Your Information is Protected When You Sign Up

Deannia Johnson, CEO, Johnson Family Insurance Group

Want to Speak with one of our Insurance Agents???

Click below to schedule a Consultation!!

© 2025 Johnson Family Insurance Group, LLC - All Rights Reserved